Three of the leading contenders for the Democratic presidential nomination want to ban fracking in the United States. Senators Bernie Sanders, Elizabeth Warren and Kamala Harris have come out against fracking for oil and natural gas, promising to end the practice once in the White House. In addition, a group of political activists sent a letter to the United Nations asking the General Assembly to endorse a global ban on fracking. Environmentalists hope a ban on fracking would reduce U.S. reliance on fossil fuels, while other opponents of fracking have concerns about the potential for chemicals used in the process to seep into the ground and water supplies.

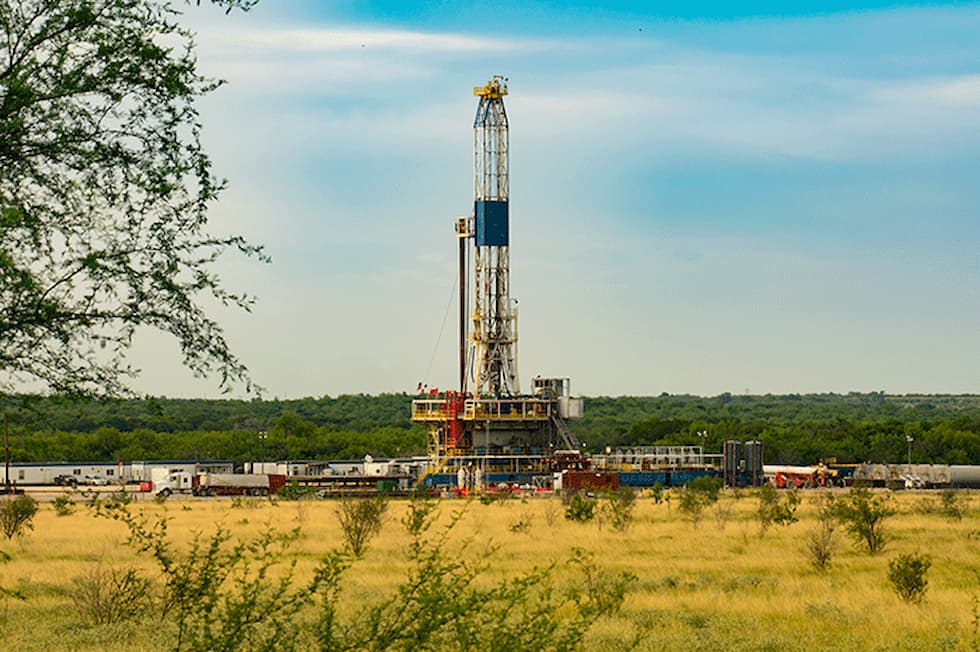

Fracking relies on two technologies: hydraulic fracturing, which involves pumping a mixture of water, sand and chemical into rock formations deep below the earth’s surface to release reserves of oil and gas; and horizontal drilling, which allows for the efficient recovery of that released oil and gas.

Fracking has led to a resurgence of American oil production, as shale oil (fracking) companies now produce more than 8 million barrels of crude oil a day, or about 10 percent of the global supply. In total, the U.S. now produces more than 12 million barrels of oil per day when other sources of production are included, compared to 5 million barrels per day in 2008.

Are these proposals to ban fracking realistic? Does the president have the authority to implement a ban, and what are the market implications of such a move?

According to a CNN fact-check report, without an act of Congress, the president could not issue an outright ban on fracking across the U.S. However, there are a number of regulatory and executive actions an administration could take to prevent or shrink the use of fracking technology, particularly on federal land. The problem is that most fracking takes place on private land, and any attempts to limit it would likely face many obstacles.

To prevent fracking on U.S. private land, an administration would have to work through regulatory powers that would face myriad legal challenges from states, businesses and local governments. If the administration worked with Congress to pass new laws on fracking, these laws could be undone by a future administration.

Sen. Warren’s campaign said it would try to enact a bill through Congress, as well as use rules and regulations (like the Clean Air Act and the Safe Water Act) to work toward eliminating fracking. Sen. Sanders’ campaign plans to take similar actions. The Obama administration attempted to increase regulations on fracking and was mostly prevented by the courts.

Market Implications for a Fracking Ban

Due to its share in the markets, energy experts say cutting off a significant portion of U.S. shale oil (fracking) supply could have profound, detrimental economic effects in the U.S.

Fracking now accounts for 60 percent to 80 percent of U.S. oil, natural gas and natural gas liquids (NGL) production. In addition, domestically produced oil and gas derived from fracking accounts for 40 percent of total U.S. primary energy consumption. According to Baker Hughes, nearly 90 percent of all new oil and gas wells drilled today are horizontal, fracked wells. An immediate ban on fracking would result in an immediate decline in U.S. oil and gas production. Net oil imports, which have been trending down for years and are currently less than 1 million barrels per day, would immediately increase and our dependence on foreign oil would begin to grow. The chart below shows how net imports of oil, natural gas and coal together have decreased significantly since 2005.

Since it is produced as a byproduct of fracking for oil, we are in the midst of a natural gas boom. With this resurgence of natural gas production, the U.S. has become the top natural gas producer in the world and has started exporting LNG to other countries. With a fracking ban, natural gas exports would move back into natural gas imports.

Liquefying and transporting natural gas abroad has become a growing business for the U.S. America’s LNG export capacity is expected to reach over 10 billion cubic feet per day in 2020, which is almost double the capacity in 2018.

Fracking produces natural gas and when we use more natural gas, we decrease our use of coal to produce electricity. The natural gas produced through fracking has become abundant, cheap and a more environmentally friendly replacement for coal in the generation of electricity. In 2016, more than 31 percent of the electricity in the U.S. was produced with coal. The global community is even more dependent on coal with more than 38 percent of total electricity generation in 2016 produced with coal. Our natural gas is a growing alternative to nations like China and India, which burn a lot of coal.

Fracking provides the U.S. with comparatively cheap gasoline, makes electricity affordable, shuts down coal-fired power plants, makes OPEC less powerful and gives Europe a choice for natural gas. Before fracking, Russia had significant control in the natural gas energy sector. The new dominance by the U.S. has created options for global consumers. Oil prices spiked this month following the attacks that disrupted about half of Saudi Arabia’s oil capacity, which accounts for about 5 percent of the daily global oil supply. The market reaction would have been much greater were it not for the substantial increase in U.S. crude oil production over the past decade made possible by fracking. A ban on fracking would reverse these things and send energy prices higher.

Although U.S. renewable power generation is growing, the pace is not fast enough to abandon fractured natural gas and oil given U.S. goals of decommissioning aging coal and nuclear power plants and reducing its reliance on foreign oil. Wind and solar are part-time energy sources and the technology for large-scale energy storage is yet to be developed. As a result, wind and solar together account for only 7 percent of U.S. electricity production and even less globally.

Despite what candidates are saying, the reality is that proposals to ban fracking are not at all practical from a political or market perspective. A combination of natural gas, wind and solar will be vital to the country’s energy requirements in the future. All three will be important and should be working together.

Sources

- The Wall Street Journal, “Fracking Ban, Embraced by Some Democratic Hopefuls, Could Hit Economy,” Sept. 22, 2019.

- CNN, “Fact Check: Some Democratic Presidential Candidates Want to Ban Fracking. Could They?” Sept. 16, 2019.

- J.P. Morgan, “Eye on the Market,” Sept. 13, 2019.

- Forbes, “Why a Ban on Fracking Will Never Happen,” Sept. 7, 2019.

- The Hill, “Fracking Ban Could Have Unintended Consequence of Boosting Coal,” Sept. 22, 2019.

- Lehigh Valley Live, “Ban Fracking? Some Democratic Candidates Ignoring the Facts,” Sept. 12, 2019.