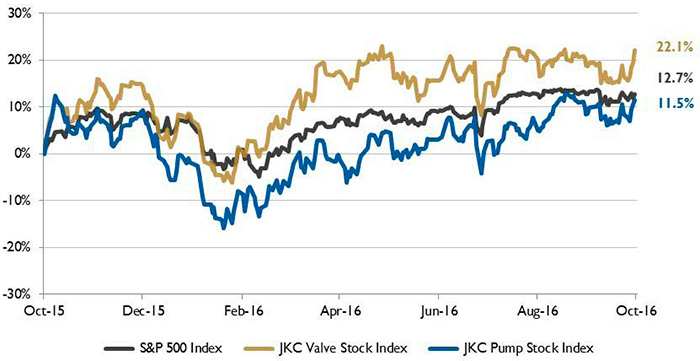

The Jordan, Knauff & Company (JKC) Valve Stock Index was up 22.1 percent over the last 12 months, while the broader S&P 500 Index was up 12.7 percent. The JKC Pump Stock Index increased 11.5 percent for the same time period.1

Figure 1. Stock indices from Oct. 1, 2015, to Sept. 30, 2016. Source: Capital IQ and JKC research. Local currency converted to USD using historical spot rates. The JKC Pump and Valve Stock Indices include a select list of publicly traded companies involved in the pump and valve industries weighted by market capitalization.

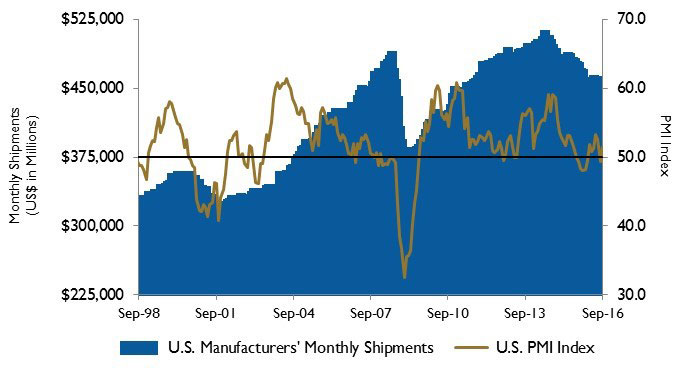

Figure 1. Stock indices from Oct. 1, 2015, to Sept. 30, 2016. Source: Capital IQ and JKC research. Local currency converted to USD using historical spot rates. The JKC Pump and Valve Stock Indices include a select list of publicly traded companies involved in the pump and valve industries weighted by market capitalization.The Institute for Supply Management’s Purchasing Managers’ Index (PMI) increased to 51.5 percent in September from 49.4 percent in August. The New Orders Index rose 6.0 percent during the month, moving from 49.1 percent to 55.1 percent. The Production Index also grew 3.2 percent, reaching 52.8 percent for the month. All three of these indices moved from contraction to expansion territory. The average reading of the PMI over the last 12 months is 50.3 percent.

The Commerce Department reported that U.S. gross domestic product grew 1.4 percent on an annual basis in the second quarter. Growth in overall business investment showed a 1.0 percent annual rate of expansion, the first gain since the third quarter of last year. Consumer spending was robust, rising 4.3 percent at an annual rate.

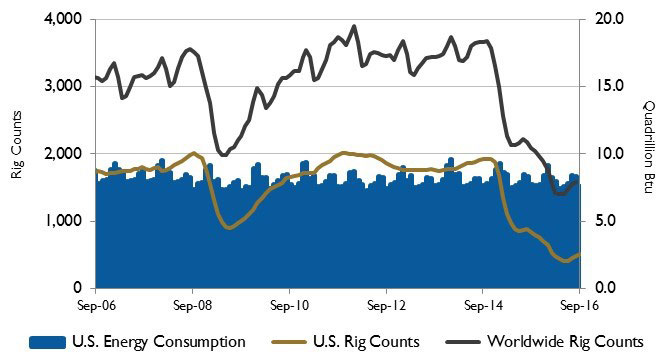

Figure 2. U.S. energy consumption and rig counts

Figure 2. U.S. energy consumption and rig countsLed by rising production in Iraq and Saudi Arabia, the Organization of Petroleum Exporting Countries (OPEC) crude oil production averaged 31.8 million barrels per day in 2015, an increase of 0.8 million barrels per day from 2014. OPEC crude oil production is forecast to rise by 0.7 million barrels per day in 2016, with Iran accounting for most of the increase, and by an additional 0.5 million barrels per day in 2017. The forecast does not take into account the outline of an agreement reached at the end of September between OPEC members that would cut production for the first time in eight years. Many details of the agreement remain to be worked out, but Saudi Arabia agreed to exempt Iran from production caps.

Figure 3. U.S. PMI and manufacturing shipments

Figure 3. U.S. PMI and manufacturing shipmentsIn the first half of 2016, propane surpassed motor gasoline to become the second largest U.S. petroleum product export, following distillate. The U.S. exported 4.7 million barrels per day of petroleum products in the first half of the year, an increase of 500,000 barrels per day over the first half of 2015 and almost 10 times the crude oil export volume. Exports to Asia and Oceania accounted for 94 percent of the growth in propane exports, increasing from 562,000 barrels per day in the first half of 2015 to 793,000 barrels per day in the first half of 2016. Japan was the largest importer of U.S. propane.

On Wall Street, the Dow Jones Industrial Average and S&P 500 Index declined 0.8 percent and 0.1 percent, respectively, in August. The NASDAQ Composite rose 1.7 percent. For the third quarter, the Dow, S&P 500 and NASDAQ all gained, rising 2.1 percent, 3.3 percent and 9.7 percent, respectively. The markets rebounded as corporate earnings were better than expected and the Federal Reserve reduced concerns over an interest rate increase. Hopes of a crude oil production freeze were increased when OPEC members agreed that they needed to decrease output.

Reference

1. The S&P Return figures are provided by Capital IQ.

These materials were prepared for informational purposes from sources that are believed to be reliable but which could change without notice. Jordan, Knauff & Company and Pumps & Systems shall not in any way be liable for claims relating to these materials and makes no warranties, express or implied, or representations as to their accuracy or completeness or for errors or omissions contained herein. This information is not intended to be construed as tax, legal or investment advice. These materials do not constitute an offer to buy or sell any financial security or participate in any investment offering or deployment of capital.