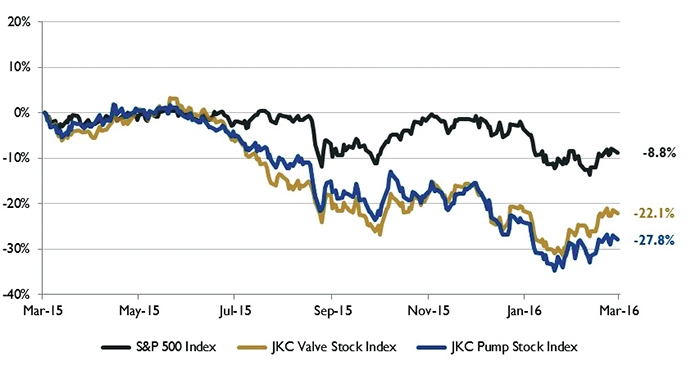

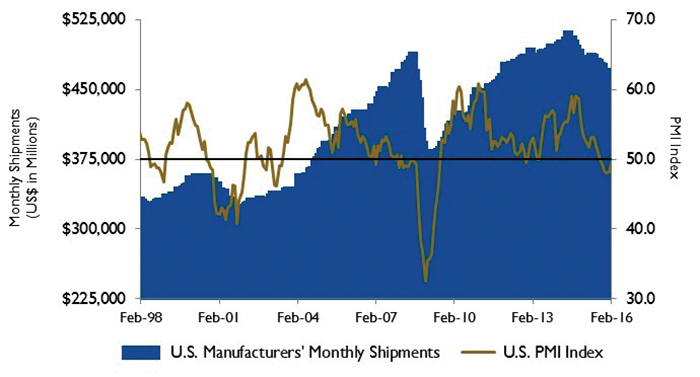

The Jordan, Knauff & Company (JKC) Valve Stock Index was down 22.1 percent over the last 12 months, while the broader S&P 500 Index was down 8.8 percent. The JKC Pump Stock Index also decreased 27.8 percent for the same time period.1 In February, the Institute for Supply Management’s Purchasing Managers’ Index (PMI) increased to 49.5 percent from the January reading of 48.2 percent but remained in contraction territory for the fifth month in a row. The New Orders Index, a forward-looking component of activity, remained positive at 51.5 percent for the second consecutive month. Twelve of 18 industries reported growth in new orders, including textile mills, wood products, furniture and related products, machinery, plastics and petroleum. A chemicals producer noted that U.S. business demand is solid, but international demand is soft.

Figure 1. Stock Indices from March 1, 2015, to Feb. 29, 2016. Source: Capital IQ and JKC research. Local currency converted to USD using historical spot rates. The JKC Pump and Valve Stock Indices include a select list of publicly-traded companies involved in the pump and valve industries weighted by market capitalization.

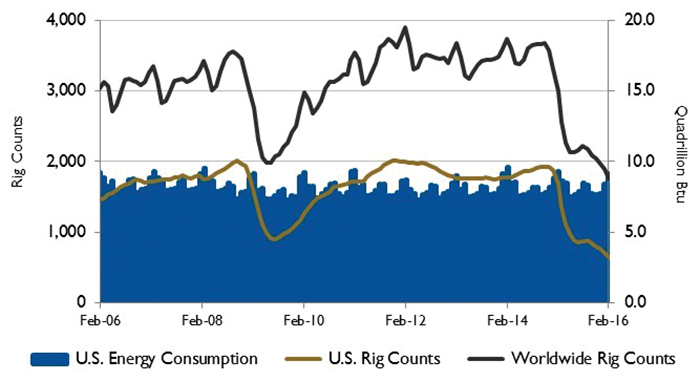

Figure 1. Stock Indices from March 1, 2015, to Feb. 29, 2016. Source: Capital IQ and JKC research. Local currency converted to USD using historical spot rates. The JKC Pump and Valve Stock Indices include a select list of publicly-traded companies involved in the pump and valve industries weighted by market capitalization. Figure 2. U.S. energy consumption and rig counts. Source: U.S. Energy Information Administration and Baker Hughes Inc.

Figure 2. U.S. energy consumption and rig counts. Source: U.S. Energy Information Administration and Baker Hughes Inc. Figure 3. U.S. PMI and manufacturing shipments. Source: Institute for Supply Management Manufacturing Report on Business and U.S. Census Bureau

Figure 3. U.S. PMI and manufacturing shipments. Source: Institute for Supply Management Manufacturing Report on Business and U.S. Census Bureau