Key Takeaways on General Mergers & Acquisitions Activity in 2024

- Deal activity rebounded in 2024 starting in Q4 2023 after two years of subdued activity (2022 and 2023).

- Valuations overall, on a global basis, were steady in 2024 vs. the prior two years, although they were down by 20% from the peak in 2021 on a multiple of earnings before interest, taxes, depreciation and amortization (EBITDA) basis.

- Valuations for United States private equity transactions experienced a decline in the upper end of the middle market ($100 million – $500 million).

General M&A Activity & Valuations 2024

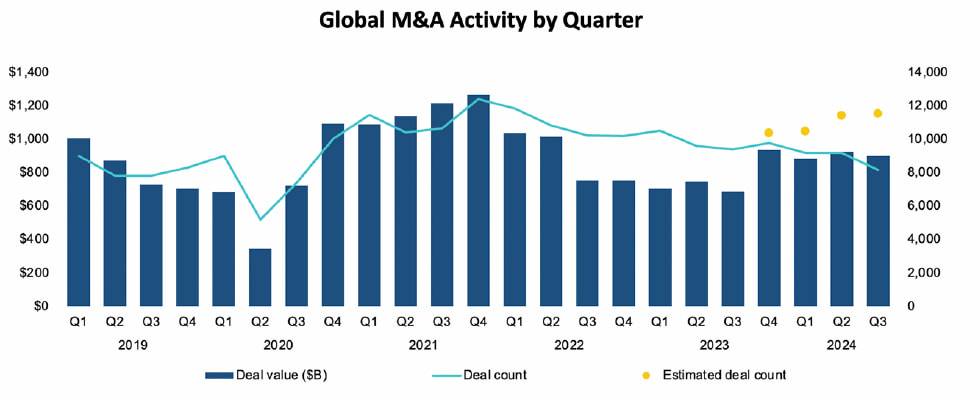

From the peak levels of 2021, both measures of deal activity—total deal value (the total of disclosed and estimated deal values) and deal count (the number of announced deals)—had fallen through Q3 2023. From 2021, deal values declined by 29% and deal count by 8.0% over 2022 and 2023 before reversing that downward trend starting in Q4 2023.

The factors driving the downturn in 2022 and 2023 have been thoroughly discussed, including interest rates and an uncertain growth outlook as well as conflicts in Europe and the Middle East. It would seem that beginning in Q4 2023, buyers, particularly corporate buyers, started to find those macro factors less intimidating and revived their deal activity, joined by private equity later in 2024.

The deal count, as shown by yellow dots in Image 1 (the yellow dots show where PitchBook estimates the deal counts will be once all data is processed), returned to levels close to those of 2021—only down by 2.5% on a trailing twelve months (TTM) basis through Sept. 30, 2024. On the other hand, total deal value remains down significantly—22.5% on a TTM basis thru Sept. 30, 2024 vs. 2021. While deal value is an important metric, it is impacted by a variety of factors that impact total deal value such as deal size, industry mix and transaction valuations.

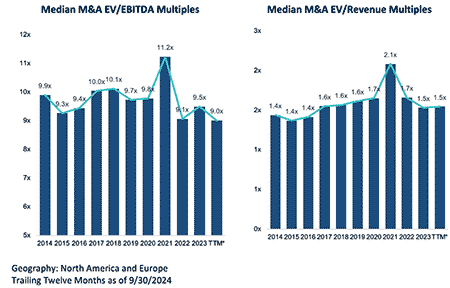

The above data from PitchBook shows current global enterprise value (EV)/EBITDA multiples are down 20% from the 2021 peak (9.0x vs. 11.2x) but close (93%) to the 10-year median EV/EBITDA multiple of 9.7x. Likewise, the enterprise value-to-revenue multiple (EV/R) is down almost 30% from the 2021 peak (1.5x vs. 2.1x) but not far off (94%) the 10-year median EV/R (1.5x vs. 1.6x). We should keep in mind that in 2021 we had near perfect storm conditions for M&A.

Interest rates were near zero (the effective funds rate in the U.S. in 2021 ranged from 0.08% to 0.09% according to data from the St. Louis Federal Reserve) vs. the rate of 4.8% in November 2024. The global real gross domestic product (GDP) growth in 2021 was 6.6% according to data from the International Monetary Fund vs. 3.3% in November 2024.

It would seem reasonable to conclude the conditions driving forces for deal activity and valuations in 2021 were an anomaly and we have returned to more normal conditions. Although the interest rates in the U.S. are still at nearly their highest level in the last 20 years, which was 6.55% in November 2000 according to the St. Louis Federal Reserve, interest rates are likely to decline in 2025 barring a reignition of inflation.

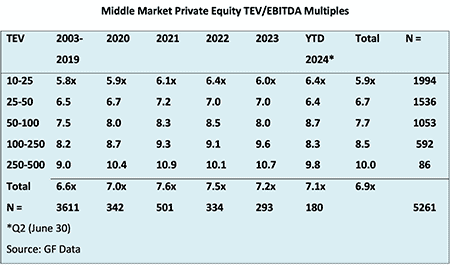

The data in Image 3 shows the average total enterprise values (TEV)/EBITDA multiples reported to GF Data by a pool of 250 private equity firms. This provides information on private transaction valuations that are usually not disclosed and therefore are difficult to know on a reliable basis. As can be seen in Image 3, there is a significant difference in valuations from the smallest TEV range ($10 million – $25 million) to the largest range ($250 – $500 million). It should be kept in mind that these are average numbers and the value of a specific business can be in a range that could typically be +/- 1x the ranges shown—or perhaps more for companies that are highly sought after in a competitive process.

This information indicates some softening in valuations at the start of 2024 in some size ranges, primarily in the two largest ranges, while strengthening in two of the three smaller ranges. The strengthening of valuations in the smaller deal sizes may be an indication of where the demand was strongest for bolt-on opportunities.

Fluid Handling Industry M&A Activity & Valuations 2024

Key takeaways on the fluid handling industry M&A activity in 2024:

- Deal activity in the fluid handling industry slowed by about 10% in 2024 vs. the levels of the prior two years (2022 and 2023); however, activity was showing a pickup in Q2 and Q3, and Q4 is expected to be a continuation of the higher level of activity when the numbers are in.

- Deal activity is driven primarily by corporate buyers; however, financial sponsors are an important factor, accounting for about 25% of the acquisition activity in the industry.

- Water continues to be the predominate end use market sector targeted by acquirers.

- Distribution and service businesses are the predominant type of business targeted by acquirers.

- Median valuations in the industry have fluctuated over the last three years, along with the significant fluctuation in median deal size. Disclosed valuations on individual deals show that valuations remain transaction specific.

Water Is the Most Targeted End Use Market

Water continues to be the most sought-after end use market other than the diversified category. In the water category, the U.S. was the most targeted geography (72%), and distribution and/or service businesses were the predominate types of businesses acquired (72%) in the water space.

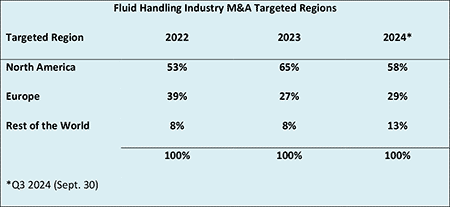

North America Is the Most Targeted Region

Image 5 shows that North America continues to be the most targeted geography. Key factors for the focus on North America are likely the relative strength of the U.S. economy and growth outlook (real 2025 GDP growth rate projection of 2.2% in the U.S. vs. 1.2% in the Euro Area and 1.5% in the United Kingdom per the International Monetary Fund Report October 2024), as well as the ongoing consolidation of the U.S. distribution/service businesses.

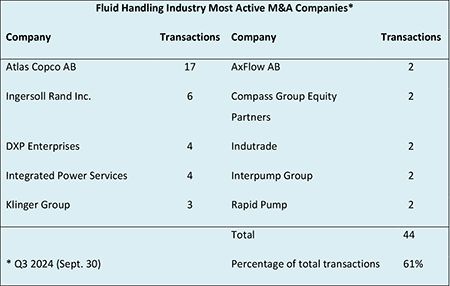

Fluid Handling Industry M&A Activity Concentrated With Most Active

As shown in Image 6, there were 10 companies that made multiple acquisitions, accounting for 61% of the M&A deals in the industry through Q3 2024 (Sept. 30). Of this most active group, five are based in Europe (Atlas Copco, Klinger Group, AxFlow AB, Indutrade and Interpump Group), and three are private equity sponsored (Integrated Power Services, Compass Group Equity Partners and Rapid Pump).

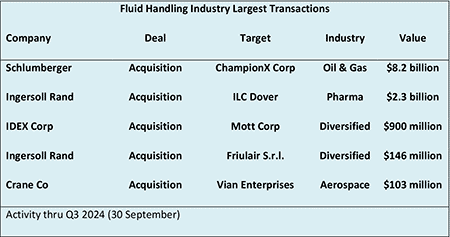

Fluid Handling Industry’s Largest Transactions

The Schlumberger acquisition of ChampionX is an all-stock transaction. The agreement places a value of $40.59 per ChampionX share, which represents a 14.7% premium based on the closing price of April 1, 2024 (the day prior to the announcement). The acquisition of ChampionX strengthens Schlumberger’s capabilities in the production space, with production chemicals and artificial lift technologies.

Ingersoll Rand’s acquisition of ILC Dover marks the company’s next phase of their long-term vision to expand into higher-growth end markets like life sciences. In connection with this acquisition, Ingersoll Rand will establish a life sciences platform within its Precision and Science Technologies (P&ST) segment, consisting of ILC plus Ingersoll Rand’s life science-focused brands. The acquisition expands Ingersoll Rand’s addressable market by more than $10 billion, to a total addressable market of approximately $65 billion. The purchase multiple of approximately 17x 2024E Adjusted EBITDA is supported by adjusted EBITDA margins in the mid-30s and a 3-year historical organic revenue compound annual growth rate (CAGR) in the mid-teens, which are both immediately accretive to the P&ST segment.

Ingersoll Rand’s acquisition of Friulair will give the company the opportunity to accelerate growth across food and beverage and pharmaceutical end markets, in addition to scaling Ingersoll Rand’s existing air treatment business. The addition of Friulair will increase the scale of Ingersoll Rand’s air dryer business, significantly increasing the company’s access to the original equipment manufacturer channel and adding new chiller production capabilities. It also adds manufacturing locations in Cervignano del Friuli, Italy, and Si Racha, Chonburi, Thailand. Through the realization of synergies and the deployment of IRX, Ingersoll Rand expects to realize adjusted EBITDA margins in excess of 30% by year three of ownership.

IDEX Corporation’s acquisition of Mott Corporation brings scale to IDEX’s growing suite of focused, high-value businesses—including IDEX Optical Technologies, the Muon Group and recently acquired Iridian Spectral Technologies and STC Material Solutions—that address customer demand for novel solutions and expertise across advanced materials, microscale features, precision components and proprietary production processes. The agreement calls for IDEX to acquire Mott Corporation and its subsidiaries (“Mott”) for cash consideration of $1 billion, subject to customary adjustments. When adjusted for the present value of expected tax benefits of approximately $100 million, the net transaction value is approximately $900 million. This represents approximately 19x Mott’s forecasted full year 2024 EBITDA and a mid-teens multiple based on forecasted 2025 EBITDA. The transaction is expected to be accretive to adjusted earnings per share in fiscal year 2026.

In the acquisition of California-based Vian Enterprises, the Crane Company gains a global designer and manufacturer of multistage lubrication pumps and lubrication system components technology for critical aerospace and defense applications with sole-sourced and proprietary content on the highest volume commercial and military aircraft platforms. The acquisition further strengthens the company’s positioning for future content opportunities on engines, gearboxes and auxiliary power units. According to the company’s announcement, the purchase price was approximately $103 million, and they expect Vian’s margins will be accretive to the Aerospace & Electronics’ segment EBITDA margins immediately, with a long-term sales growth rate in line with the segment’s 7% to 9% long-term CAGR.

Thoughts About 2025 Fluid Handling Industry M&A

- The demand for quality acquisitions will likely be stronger in 2025, and potentially significantly stronger, should CEO confidence be buoyed by the prospect of lower tax rates and an overall more business friendly environment with the change in the U.S. administration.

- An improved level of CEO confidence will also help to close the buyer/seller valuation gap—buyer’s risk analysis would likely shift to being more averse to missing a quality opportunity.

- With the anticipated change in the regulation environment, we may see a return to more large deals along with a continuation of the middle market deals that are more bolt-on in nature.

- We can expect to see more deals targeted on the energy sector, particularly oil and gas.

- In the middle and lower middle market, we can expect to see a continued focus toward distribution and service companies—manufacturing company targets are down from 61% of the industry transactions in 2022 to 44% year to date 2024.