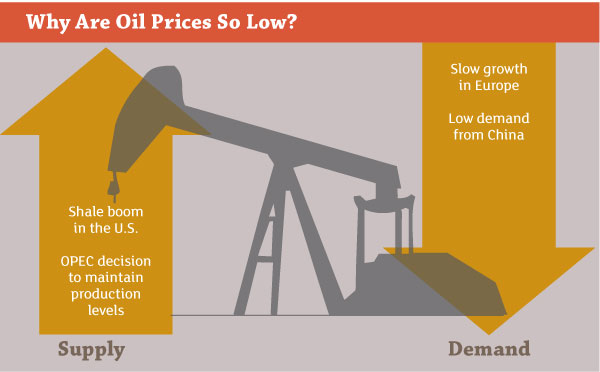

The Middle East has a significant share in the global oil market and accounts for more than 45 percent of the global oil reserves. However, subdued global demand for crude oil has resulted in a downward spiral in crude oil prices. Weakening global demand for oil and sustained output by nations outside the Organization of Petroleum Exporting Countries (OPEC) will likely result in a period of high volatility and uncertainty in 2015. Despite the downturn in crude oil prices, national oil companies (NOCs) are determined to move ahead with investments in the oil and gas sector. These investments will proceed slowly as governments hope that oil prices will recover later in the year. For the long term, the Middle East will likely focus on several measures to alter its energy mix, including natural gas and renewable energy. Enhanced oil recovery techniques and unconventional sources, such as shale and sour gas (gas containing significant amounts of hydrogen sulfide), will gain more attention from NOCs in the coming years.

Offshore Developments

Upstream production in the Middle East has traditionally been from onshore fields. These fields are both abundant in the region and relatively easy to access. As the fields have aged and production levels decreased, there have been increased investments in offshore fields in the last two to three years. The shallow waters of the Arabian Gulf account for most of the current-day exploration and production activity. The Red Sea and Mediterranean Sea are expected to be the next major E&P focus areas. Several large-scale, capital-intensive offshore projects are underway in the region, and the trend is likely to be in favor of offshore E&P activity. Saudi Arabia, the United Arab Emirates and Qatar are the Middle Eastern countries driving these investments.