Thu, 09/22/2016 - 07:27

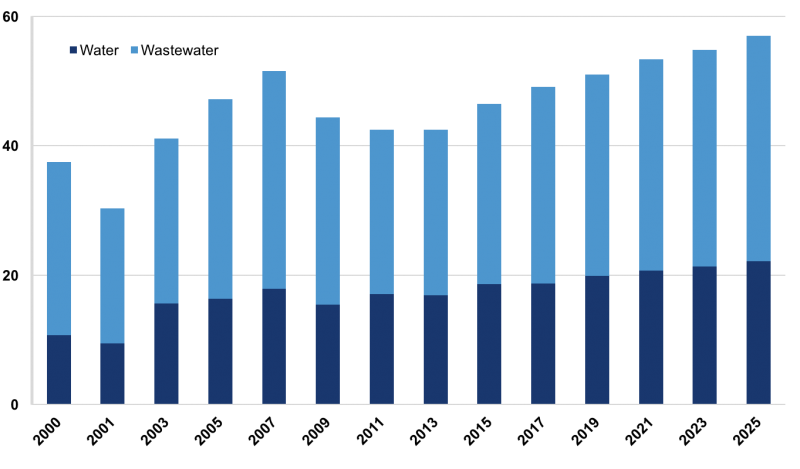

BARCELONA, Spain (Sept. 22, 2016)—European utilities are planning to invest more than $526 billion in water and wastewater infrastructure between 2016 and 2025, according to a new forecast from Bluefield Research. A combination of drivers including utility market restructuring, water and wastewater directives, and improved efficiency have encouraged cities and public water utilities to resume the most aggressive investment programs Europe has seen since 2007. Bluefield anticipates annual water infrastructure investment to increase 23 percent, from $46 billion in 2015 to $57 billion in 2025.

Total EU Water & Wastewater CAPEX Forecast, 2016-2025 (Courtesy of Bluefield Research)

Total EU Water & Wastewater CAPEX Forecast, 2016-2025 (Courtesy of Bluefield Research)