The freefall in electric motor sales is a direct effect of the worldwide economic downturn, which has severely depressed industrial and commercial productions. Despite the 20 to 30 percent drop in motor sales in 2009, manufacturers remain optimistic about the future market landscape, as the economic recovery, the need to improve energy efficiency and the demand in high growth sectors will create need for high performance motors.

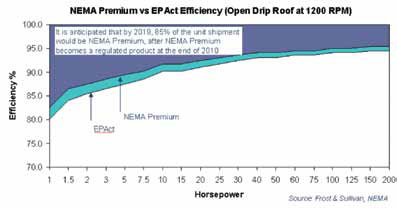

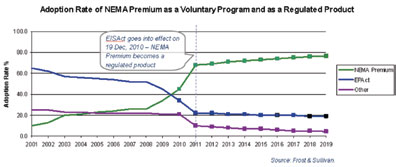

When selecting a new motor today, a buyer has two choices for electric motor efficiency: EPAct (Energy Policy Act of 1992) efficiency or NEMA (National Electrical Manufacturers Association) Premium efficiency, which has a higher efficiency requirement and costs 10 to 15 percent more than motors that just meet the EPAct standard. With the passage of the Energy Independence and Security Act of 2007 (EISA), all general purpose motors of at least 1 hp and less than 200 hp will have to meet or exceed NEMA Premium motor efficiency levels beginning on December 19, 2010.

Figure 1

As a result of this legislation, motor selection is likely to be consolidated, and NEMA Premium is expected to become the new industry motor efficiency standard. The inclusion of the NEMA motor efficiency standards into U.S. law and the recognition of NEMA standards by environmental groups, such as American Council for an Energy Efficient Economy (ACEEE), has resulted in a resurgence in a mature electric motors market.

Despite the high premium costs associated with high efficiency motors and concerns of making new capital investments amidst an uncertain economic environment, the trend toward higher energy efficiency has been gaining momentum in North America. To adhere to EISA, end users are replacing less efficient motors with NEMA Premium efficiency motors.

The U.S. Congress and President Obama passed the American Recovery and Reinvestment Act, aka “The Stimulus Plan,” which provides funding for the federal government, states and cities to improve energy efficiency in buildings and schools. ARRA also provides enhanced incentives for consumers to upgrade existing heating and cooling equipment and allows consumers to purchase energy efficient HVAC systems, energy efficient motors and energy efficient water heaters. These incentives include receiving a tax credit up to 30 percent of the cost for energy efficient products. The stimulus encouraged consumers to make their homes more energy efficient, and also drives the sales of high efficiency motors.

To offset the price factor associated with NEMA Premium motors and encourage faster adoption, the U.S. Senate's Energy and Natural Resources Committee voted in favor to adopt the NEMA advocated premium energy-efficient motor rebate program, known as “crush for credit.” Once the $700 million motor rebate bill is passed, it will provide a $25 per horsepower rebate for the purchase of NEMA Premium energy efficient motor, and a $5 per horsepower rebate for the disposal of the old, non-NEMA Premium motor.

Figure 2

With all the emphasis on energy independence, other opportunities for electric motors exist. Wind power is gaining acceptance and becoming an increasingly cost-effective and clean alternative to conventional energy sources. Electric AC motors and servo motors are used in yaw drives, pitch controls and other control systems. The North American wind power market has experienced tremendous growth during the last three years, growing at an average annual growth rate of 37 percent from 2006 to 2009, and reached a capacity of 34,000 MW and $13.5 billion in revenue in 2009. Increasing government concerns about energy security and independence, government incentives on renewable energy and other factors such as rising energy prices and volatility of fuel costs have contributed to the accelerated market growth.

Looking forward, wind power continues to be a strong growth sector; it is expected to reach a capacity of 127,000 MW and $37.1 billion in revenue by 2015, with an average annual growth rate of 24 percent. Since electrical and control systems (including yaw systems, pitch system, brake system, power converter and transformers) account for 13.8 percent of the capital cost of a wind turbine generator system, electric motors used in wind energy are projected to experience strong growth to meet the strong demand.

Manufacturers moved quickly to make changes to their product offering to ensure NEMA Premium compliance and began moving more inventory to the new levels to ensure availability and a smooth transition to high performance motors. Furthermore, manufacturers are seeking opportunities within the high growth sectors, such as wind energy, to stay competitive. With the economic recovery, requirement to meet energy efficiency standards and demand from high growth sectors, the electric motors market is expected to see a fast recovery.

Pumps & Systems, September 2010