Carbon capture and storage is forecasted to play a vital role in decarbonization, particularly for hard-to-abate sectors like refining, chemical and cement. Estimates suggest CCS could reduce 5-10% of total global carbon dioxide emissions by 2050, relative to 2023 levels.

The latest World Energy Outlook from the International Energy Agency (IEA) underscores CCS’s importance, with the Announced Pledges Scenario (APS) projecting a dramatic increase in captured carbon dioxide (CO2) from approximately 40 million metric tons (mt) in 2023 to 410 mt and 2,143 mt in 2030 and 2040, respectively. Under the less ambitious Stated Policies Scenario (STEPS), captured CO2 increases to 122 mt and 261 mt in 2030 and 2040, respectively, with fewer than half of the announced CCS projects realized. The IEA CCS Projects Database tracks more than 700 CCS projects globally. If fully implemented, these projects could capture, transport and store approximately 2,150 mt of CO2, highlighting the scale of CCS’s potential impact.

The Role of Centrifugal Pumps in CCS

Centrifugal pumps are mission-critical fluid handling equipment that are poised to play a pivotal role in scaling up CCS. They are essential not only for direct conveying of CO2, but also supporting the balance of plant operations at a carbon capture facility. These include circulating solvents for capturing CO2, transporting and circulating feedwater and moving other fluids essential to BoP operations. When considering all pump types across a CCS facility, pumps and their associated systems can represent over 10% of the total facility cost, underscoring their critical role in the site's overall financial performance.

Market Outlook for Centrifugal Pumps in CCS

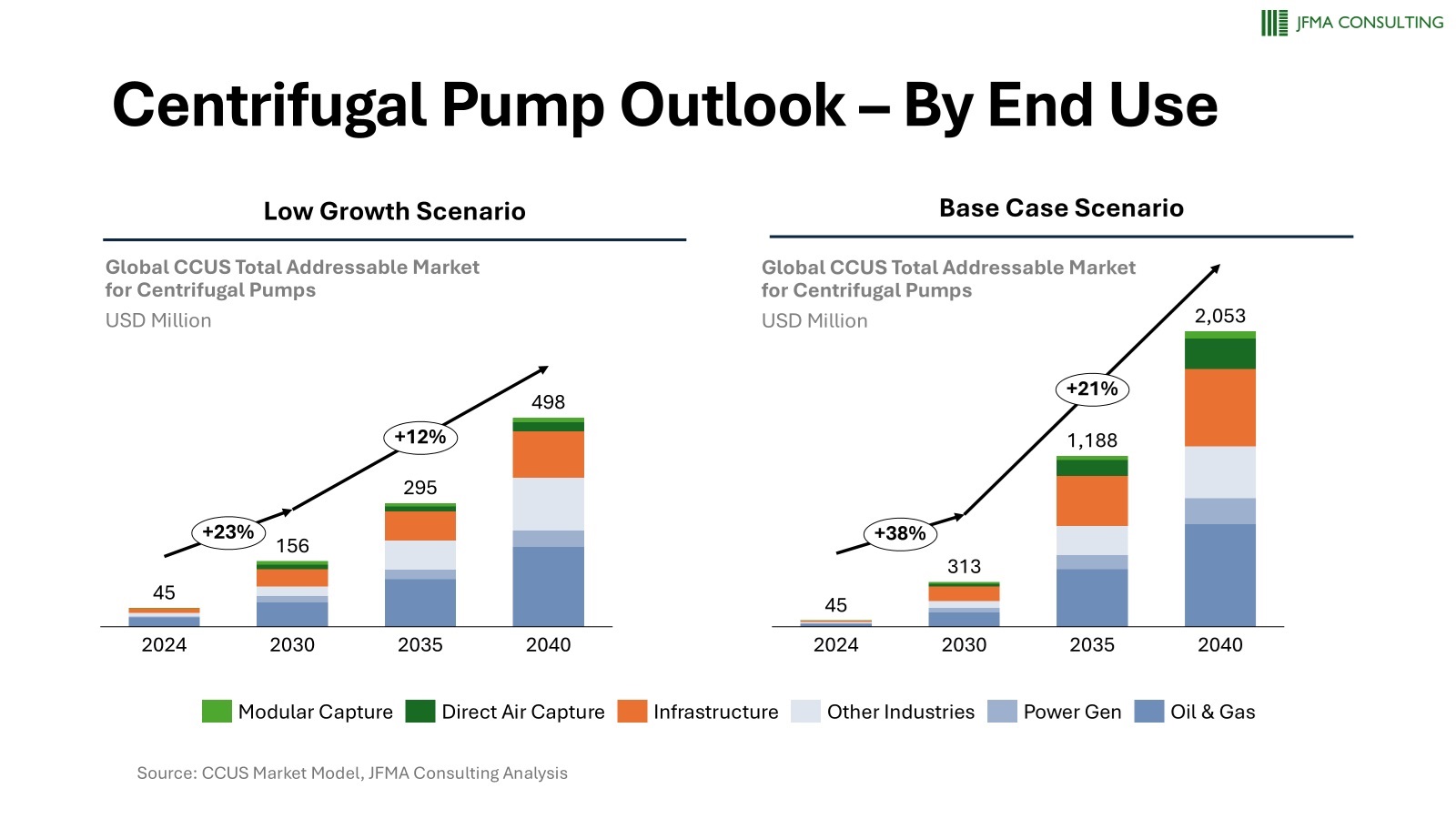

In the published base case scenario aligned with the 2024 IEA APS, the total centrifugal pump addressable market is projected to grow to reach approximately $2.0 billion by 2040 with a compound annual growth rate (CAGR) of around 26%.

- Regional dynamic: North America, with its established infrastructure of operational CCS facilities and CO2 pipelines, will account for the largest market, estimated at approximately 50% (Image 1). Other key growth regions include China and energy producing regions in Europe and the Middle East, although growth is contingent on the adoption of attractive policies and economic incentives.

- End-use market: Oil and gas facilities with CCS, in applications such as low-carbon hydrogen, natural gas processing and liquid natural gas (LNG), are forecasted to be the largest market (Image 2). The market in CO2infrastructure, including transportation of CO2 via pipelines and injection for sequestration, also represents a substantial opportunity. Other sectors with both large market opportunities include power and heat generation, biofuels and cement.

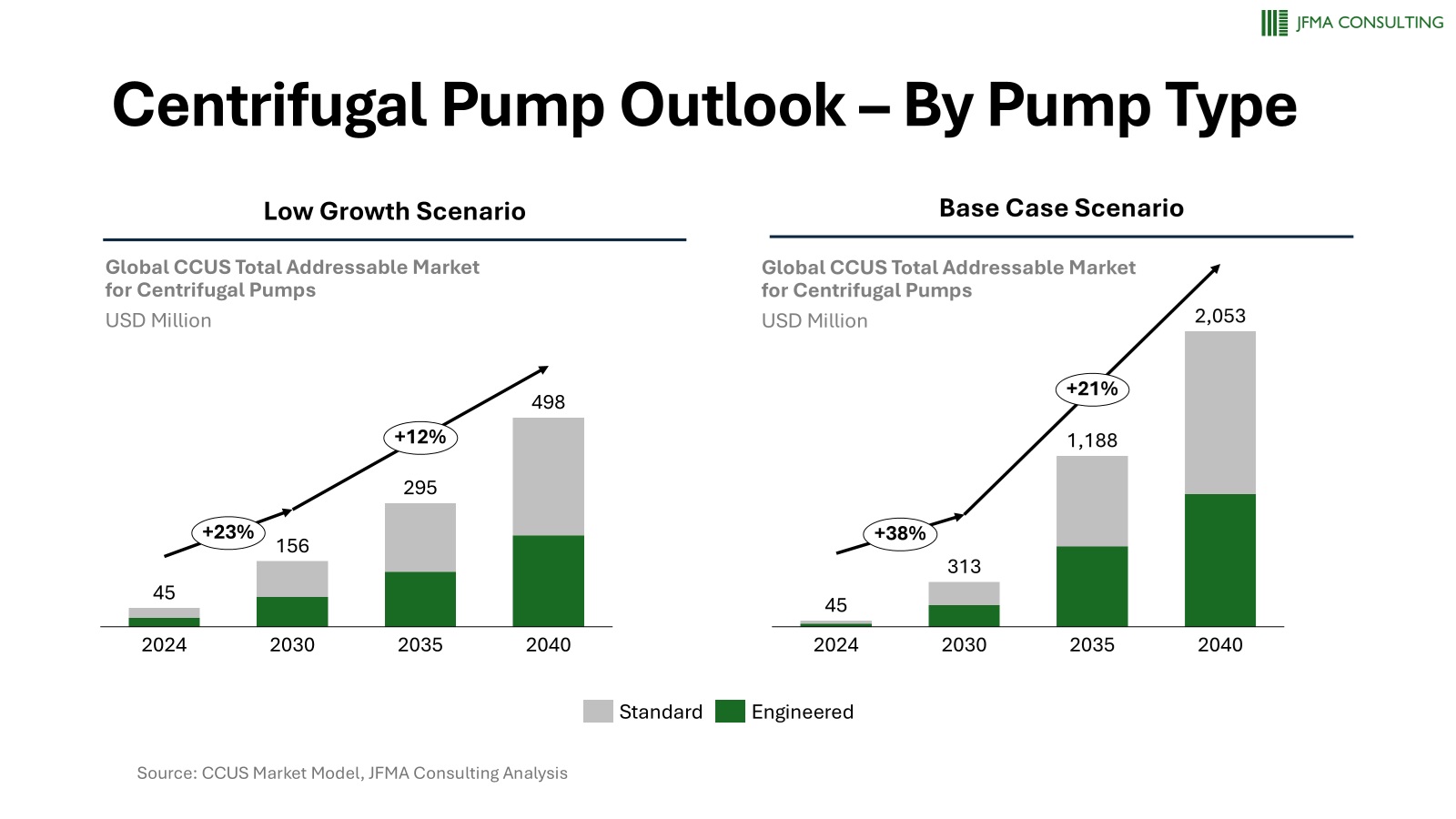

- Pump type: Engineered centrifugal pumps such as pipeline booster applications could constitute approximately 50% of the market value by 2030. Standard pumps, especially in solvent and water circulation applications, are expected to become more prevalent by the 2030s, and this is forecasted to reduce overall total cost of ownership for CCS equipment. The split of engineered versus standard pumps growth is shown in Image 3.

- Aftermarket dynamic: The aftermarket and maintenance, repair and operations (MRO) services market could reach approximately $1.4 billion by 2040, offering attractive margins through repair and replacement services.

Even in the lower growth scenario, the centrifugal pump market could reach approximately $500 million by 2040, presenting targeted growth opportunities in North America, aftermarket services and select engineered pump applications.

Growth Opportunities

As the CCS market evolves, pump manufacturers and independent rotating equipment service companies have significant opportunities to grow.

Many of the pump manufacturers already have centrifugal pump references and an installed base in operational CCS facilities. Several have announced CCS as a strategic growth priority and are prioritizing winning flagship projects in this market. Independent service providers are also expected to play a key role and have started to craft strategies on how to compete as the CCS market expands.

Companies aiming to build a leading position in the CCS market should consider a set of targeted actions as part of a comprehensive CCS strategy with a clear implementation roadmap.

- Develop a scenarios-based CCS strategy and roadmap.

- Establish a comprehensive, scenarios-based strategy, taking into consideration potential CCS market size and growth, scalability, product and customer differentiation as well as how to create optionality to pivot if the market accelerates or takes longer to develop.

- Develop a clear implementation roadmap that takes into consideration the factors stated above along with financial investment requirements, resource and capability constraints and other competing strategic priorities.

- Strengthen commercial and marketing efforts.

- Leverage existing installed base – Companies should prioritize systematic documentation of existing pump installed bases in operational CCS sites to understand references, performance history and technical capabilities.

- Prioritize existing customers – Develop targeted sales and marketing strategies to prioritize existing customers that are funding new CCS projects.

- Market-proven capabilities – Launch new marketing campaigns highlighting proven CCS pump solutions, deploying AI-driven tools for content development and enhanced outreach.

- Invest in training – Develop training programs to improve the knowledge of pump solutions in CCS for both internal sales teams and external customers.

- Product management and innovation.

- Define flagship products – Identify and prioritize the preferred flagship products to offer across existing CCS applications.

- Pursue value engineering – Invest in value-engineering solutions that reduce upfront product and/or running costs for CCS pumps.

- Strategically invest in new technology innovation – Develop new innovation in areas such as advanced materials and new digital monitoring solutions. Leading pump innovators can not only gain a technological edge in CCS applications, they can leverage these advancements across their entire portfolio to improve return on investment (ROI) and competitiveness.

- M&A and industry collaboration.

- Strategic acquisitions – Actively evaluate and strategically pursue M&A opportunities within the CCS sector, particularly to address technology gaps and expand into new, attractive CCS markets.

- Strengthen industry collaboration efforts with suppliers, EPCs and operators, as this is seen as pivotal to scaling up the ecosystem. Examples include more open information sharing, collaborative research and development, (R&D) and setting industry-wide standards.