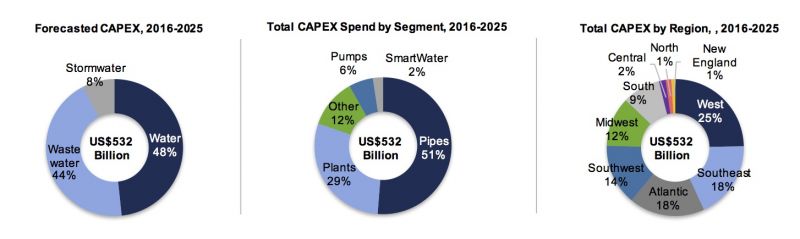

BOSTON, Massachusetts (June 29, 2016)—Capital expenditures for U.S. municipal water and wastewater utilities—including spending on pipes, plants and pumps—are expected to exceed $532 billion between 2016 and 2025, according to new forecasts from Bluefield Research. This new outlook, which draws heavily from planned utility budgets, represents a 28 percent increase over capital expenditures (CAPEX) during the last 10 years. “Our research indicates that the water utility sector has finally emerged from the economic downturn, which undercut public spending in water infrastructure by almost 15 percent from 2009 to 2014,” according to Reese Tisdale, President of Bluefield Research. “We anticipate a surge of network upgrades to address aging infrastructure, scaling populations, and tightening environmental regulations nationwide that will usher in new infrastructure technology and financing solutions.” While CAPEX is forecasted to rebound, a significant decrease in federal funding for water utilities—which has fallen to $4.3 billion in 2014 from $16 billion in 1976—passes the burden onto states, municipalities and ultimately ratepayers. Residential and sewer bills have increased 5 percent and 20 percent annually, respectively, since 2000, but their impact is expected to continue falling short of infrastructure needs, according to Bluefield Research.

U.S. Municipal Water and Wastewater Outlook (Source: Bluefield Research)

U.S. Municipal Water and Wastewater Outlook (Source: Bluefield Research)