Jordan, Knauff & Company

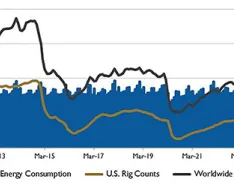

Production cuts are expected to keep global oil production below global oil consumption next year.

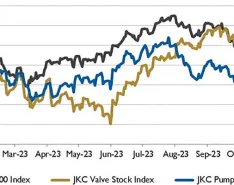

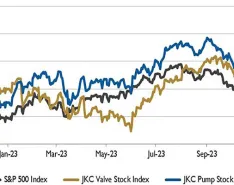

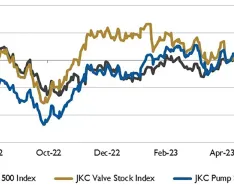

The Jordan Knauff & Company (JKC) Valve Stock Index was down 5.7% over the last 12 months, and the broader S&P 500 index was up 1.9%.

The employment index fell for the third straight month to 46.9%, its lowest reading since 2020.

As global energy supplies tighten, total U.S. exports of crude oil and refined petroleum products hit record highs.

Any unplanned supply disruption has the potential to increase oil prices quickly and significantly.

Exploration activity has been up and down this year.

The employment index fell back into contraction territory.

This model is now struggling for several reasons.

Some key inputs used in manufacturing semiconductors come out of Russia and Ukraine.

Economic growth was robust throughout 2021 as vaccinations increased and stay-in-place behaviors began to abate.

Ten industries reported growth in production during the month.

Average hourly wages were up 4.8% in November over the previous year.

Companies and suppliers continue to deal with hurdles to meet increasing demand despite increasing prices.

Factories waiting longer for supplies.

COVID-19 highlighted the fragility of the supply chain model in times of stress.

Renewed concerns over COVID-19 took a toll on hiring in August.

Renewable energy consumption increased to a record high of 11.6 quads.

The Employment Index experienced the largest drop of the month falling to 50.9%.

Pump market analysis shows Backlog of Orders Index surged to a record high.

The employment index was up 5 points from last month.

It has been a complicated 12 years since the Keystone XL project was first proposed.