The Jordan, Knauff & Company (JKC) Valve Stock Index was up 15.1% over the last 12 months, and the broader S&P 500 index was up 24.7%. The JKC pump stock index rose 21.6% for the same period.1

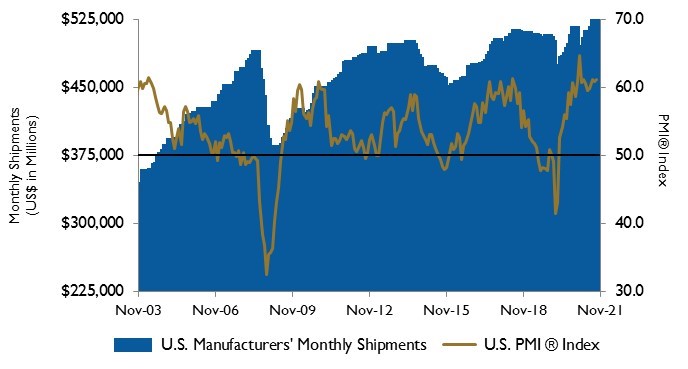

The Institute for Supply Management’s Purchasing Managers Index (PMI) rose to 61.1% in November. The prices paid index was 82.4%, a step back from 85.7% in October. Wait times for supplier deliveries and prices fell by more than three points. The employment component rose to 53.3%, the highest reading since April. Supplier deliveries were a still-elevated 72.2%, a 3.4 point drop. It is still a long wait time at the loading dock but not as long as it was in either of the two prior months.

The United States economy added 210,000 jobs in November, the smallest gain since last December and a slowdown from the upwardly revised increase of 546,000 jobs in October. Job gains have averaged 555,000 a month in 2021.

The unemployment rate fell to 4.2% from 4.6%. Employers are experiencing a shortage of workers and have been raising salaries and offering new benefits to entice new hires. Average hourly wages were up 4.8% in November over the previous year.

U.S. Federal Reserve Bank Chairman Jerome Powell suggested officials could speed up the pace of winding down asset purchases. This could set the stage for an interest rate increase early next year. Inflation was up 5% in October from a year earlier, amid strong demand for goods and services.

Spot prices of Brent crude oil and West Texas Intermediate (WTI) have risen since their April 2020 lows and are now above pre-pandemic levels. In October, the price of Brent crude averaged $84 per barrel, and the price of WTI averaged $81 per barrel, the highest nominal prices since October 2014. Since the third quarter of 2020, global consumption of crude oil and petroleum products has increased faster than production, causing lower inventory levels and higher crude oil prices.

Global crude oil demand is expected to exceed global supply through the end of the year, contribute to some additional inventory draws, and keep the Brent crude price above $80 per barrel through December 2021.

However, global oil inventories are forecast to build in 2022, driven by rising production from OPEC+ countries and the U.S. along with slowing growth in global oil demand. This shift will put downward pressure on the Brent price, which is forecast to average $72 per barrel during 2022.

On Wall Street, the Dow Jones Industrial Average fell 3.7%, the S&P 500 Index lost 0.8% while the NASDAQ Composite gained 0.3% in November.

The omicron variant threw the markets off track from a record rally. Virus panic, the anticipation of the possible Federal Reserve Bank’s interest rate rise, and inflation pressures kept investors’ sentiments uneasy.

1 - The S&P Return figures are provided by Capital IQ.