The fluid handling industry merger and acquisitions (M&A) first quarter (Q1) activity started strong and with expectations that the positive deal environment that has prevailed for the last few years would continue for 2020. Then the quarter ended with unprecedented uncertainty.

This report provides information on deal activity, valuations, notable transactions, outlook and industry transactions announced in Q1 2020.

Deal Activity

The volume of deals in the first quarter of 2020 was an uptick from the Q4 of 2019 with 18 transactions in Q1 2020 versus 15 transactions in Q4 2019. The quarter was about flat compared with the prior year when there were 17 transactions.

This year started quickly with 10 transactions in January, six in February and two in March. It would be easy to jump to the conclusion that the current economic disruption due to the dramatic drop in oil prices and the COVID-19 pandemic brought M&A activity to a standstill. However, we saw a similar pattern in Q1 2019 with only three transactions in March 2019. Also, two significant transactions were completed in the energy sector in March 2020—Warburg Pincus completed their acquisition of Sundyne and SPX Flow completed the sale of its Power and Energy business (now Celeros Flow Technology) to funds managed by Apollo Global Management, Inc.

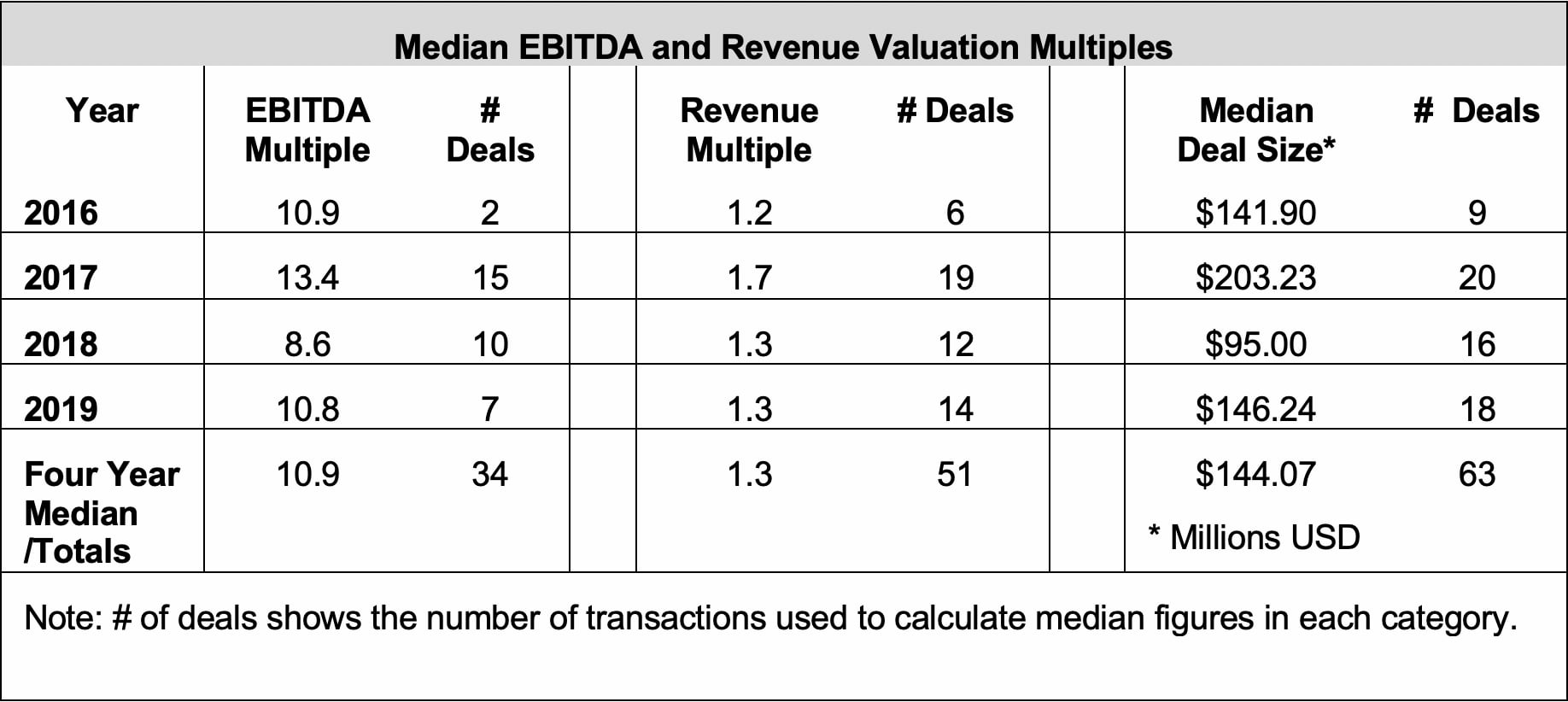

Valuations

There were two transactions with disclosed valuations in the first quarter of 2020 and that information is provided in the Announced Transactions section of this report. Below is historical information on valuations in the fluid handling industry.

Notable Transactions

Two notable transactions closed in March:

- Warburg Pincus completed the acquisition of Sundyne from funds advised by Carlyle and BC Partners. Sundyne was part of the group of companies divested by United Technologies in 2012 in a $3.46 billion transaction that formed Accudyne Industries. Sundyne was the remaining piece of Accudyne with Carlyle and BC Partners having previously sold Sullair and Milton Roy in separate transactions.

- Funds managed by Apollo Global Management, Inc. completed the acquisition of the SPX Flow Power and Energy business segment for a transaction value of $475 million. The divested business is now Celeros Flow Technology and consists of the following brands: Airpel, Copes-Vulcan, GD Engineering, Plenty, ClydeUnion, Dollinger, M&J Valve and Vokes.

Outlook

It is an understatement to say the outlook is uncertain. We will learn more as the public companies report over the next few weeks on Q1 earnings, update their guidance and discuss their plans for capital allocation in the face of these unprecedented circumstances. Clearly the short-term priority will be to conserve cash until the outlook is more certain. However, as companies start to recover the questions will be:

- Do buyers have the same strategic imperatives that were driving the strong demand for acquisitions?

- To what extent has the current situation impacted buyers’ and sellers’ risk tolerance and outlook for future growth?

As we start to recover, many of the forces that were motivating strategic and private equity buyers are likely to still be in play as well as a continuation of the low interest rates that have been a key factor in the strong valuation environment. The unknown factor that is likely to determine both supply and demand for deals is the risk tolerance for buyers and sellers. The risk tolerance for both is likely to go down. We can expect buyers to be more cautious but probably not to the point of not being willing to put capital to work, or to expand their technology or perhaps vertically integrate their channel or supply chain. On the sell side, owners are likely to have a heightened sensitivity to the ongoing risk of ownership and somewhere in that mix the market will find a new equilibrium.

If we look to what happened to worldwide deal volume and value in 2008 and 2009, we see from data published by the Institute for Mergers, Acquisitions and Alliances, that deal volume declined modestly in 2008 (4.8 percent) and more steeply in 2009 (9.9 percent), but the total value of deals fell 37.5 percent in 2008 and an additional 28.9 percent in 2009. It took until 2015 for the level deal volume and value to get back to near the 2007 level.

On the other hand, following the 2008 financial crisis GF Data saw U.S. lower-middle market deal volume fall but not valuations. The thought being that in the U.S. lower-middle market, buyers were still willing to pay for quality acquisitions but became more selective in the deals they were willing to do. It will take a few months to get a sense of where our new equilibrium will be for transaction volume and valuations.

Announced Transactions

Atlas Copco Acquires MC Schroeder Equipment Co.—January

Atlas Copco has acquired the assets of MC Schroeder Equipment Co., Inc. The company is a distributor of vacuum equipment and service solutions. They are based in Denver, North Carolina.

Atlas Copco Acquires Dr. Gustav Gail Drucklufttechnik—February

Atlas Copco has acquired Dr. Gustav Gail Drucklufttechnik GmbH. The company engages in the distribution, installation, maintenance and repair, servicing and renting of air compressors. The company, founded in 1920, is based in Cologne, Germany, and has 10 employees.

Atlas Copco Acquires Hydra Flow West—January

Atlas Copco has acquired Hydra Flow West. The company is a distributor focused on sourcing and sales of spare parts and accessories used in compressor service. Hydra Flow West has seven employees and is in Walnut, California.

Atlas Copco Acquires Dekker Vacuum Technologies Inc—February

Atlas Copco is acquiring Dekker Vacuum Technologies, Inc. The company is a supplier of vacuum equipment and service solutions for industrial applications. Dekker is based in Michigan City, Indiana, and has approximately 70 employees. In 2019, Dekker had revenues of approximately $23 million (MSEK 217). Dekker has a 22-year history of supplying vacuum solutions to industrial customers in the Midwest and across the U.S.

Core & Main LP Acquires R&B Co—March

Core & Main has entered into a definitive agreement to acquire R&B Co., based in San Jose, California. The acquisition will mark Core & Main’s 10th transaction since becoming an independent company in August 2017. R&B has been in operation for more than 70 years, serving industrial and municipal customers with a broad waterworks product offerings. The company’s origin dates to 1949.

Dover Corp Acquires Em-tec GmbH—March

Dover has entered into a definitive agreement to acquire Em-tec GmbH (“Em-tec”), a designer and manufacturer of flow measurement devices that serve a wide array of medical and biopharmaceutical applications. Following the close of the transaction, Em-tec will become part of the PSG business unit within Dover’s Pumps & Process Solutions segment. Headquartered in Finning, Germany, the company produces flow measurement equipment used in connection with cardiac, vascular and transplant surgery, dialysis and “life support” procedures, automated bioprocess monitoring, and laboratory and industrial processes where flexible tubing is used.

DXP Enterprises Acquires Pumping Systems Inc—January

DXP Enterprises, Inc. acquired Pumping Systems, Inc. on Jan. 2, 2020. Pumping Systems reported revenue of approximately $19 million. Pumping Systems, Inc. distributes industrial pumps and systems. It provides centrifugal pumps, air-operated diaphragm pumps, positive displacement pumps, metering pumps, sealless pumps, submersible pumps, self-priming pumps, mechanical seal and sealing equipment, mixers, chemical metering systems, blowers and vacuum pumps, and air compressors and dryers. Its services include aftermarket service and repair, custom engineered skids and fabrication, field service work, and specialized machining services. The company serves various markets, including chemical energy, oil and gas, food and beverage, general industrial, paints and coatings, and pulp and paper. The company was incorporated in 1978 and is based in Atlanta, Georgia.

DXP Enterprises Acquires Turbo Machinery Repair—February

DXP Enterprises, Inc. announced the completion of the acquisition of Turbo Machinery Repair, Inc. (“Turbo”), a leading pump and industrial equipment repair, maintenance, machining and labor services company. Founded in 1986, Turbo is headquartered and operates out of a single location in Richmond, California. Turbo is focused on serving customers in the chemical, water/wastewater, municipal, power and general industrial markets with approximately 23 employees. Sales and adjusted EBITDA were approximately $4 million and $750 thousand, respectively.

FLSmiths Acquires Mill-Ore Industries Inc—February

FLSmith & Co acquired Mill-Ore Industries Inc. The company supplies and services pumps, cyclones, and other mineral processing equipment. Mill-ore was founded in 1991 and is based in Timmins, Canada.

Fluidra Acquires Fabtronics—February

Fluidra has acquired Australian manufacturer Fabtronics to strengthen its R&D capabilities and to incorporate electronics design and manufacturing solutions. The purchase price for 80 percent of the shares was AUD 15 mm ($9.99), with an implicit price for 100 percent of AUD 18.75 mm ($12.5). The agreed takeover also includes a set of earnouts to take place during the following three calendar years. Fabtronics is based in Melbourne, Australia. The company features an annual turnover and EBITDA of AUD 18 mm ($12.0) and AUD 6 mm ($4.0).

Enterprise value: AUD 18.75 mm; ($12.5 mm); 1.04x Rev; 3.1x EBITDA

IDEX Corp Acquires Flow Management Devices—January

IDEX Corporation has entered into a definitive agreement to acquire Flow Management Devices, LLC (Flow MD), a provider of flow measurement systems that ensure custody transfer accuracy in the oil and gas industry, for cash consideration of $125 million, before closing adjustments. Flow MD has annual sales of approximately $60 million and will join IDEX’s energy group.

Enterprise value: $125.0 mm; 2.1x Rev

Inflexion Private Equity Partners LLP Acquires Aspen Pump—January

Inflexion has agreed to acquire Aspen Pumps a manufacturer of specialist pumps, from 3i Group. This will be Inflexion’s second period of ownership of Aspen, following a successful partnership between 2007 and 2015, during which EBITDA tripled. Aspen designs, manufactures and distributes mini pumps that remove condensate water from air conditioning and refrigeration systems. The company has offices and warehousing in the United Kingdom, France, Germany, U.S. and Australia. The group employs over 200 people and exports its products to over 100 countries. Under Inflexion’s prior ownership, Aspen saw significant organic and acquisitive growth.

KLINGER Group—January

The KLINGER Group has purchased the Swiss Aargau-based companies FRANZ GYSI AG and GYSI Dichtungstechnik. The FRANZ GYSI AG with its headquarters in Suhr, Switzerland, was formed in 1927 and operated as a family enterprise for 93 years. More than nine decades have already been spent collaborating with KLINGER, especially in sealing technology and fluid control solutions. The second company, the Rheinsulz-based GYSI Dichtungstechnik, was incorporated after taking over a sheet punching subsidiary from today’s KLINGER Kempchen. With a total of about 50 employees, the companies play an important role as suppliers for the Swiss industries district heating and cooling, process heat, gas, water and wastewater, cooling, and loose materials. Furthermore, they also provide a wide range of specialist gaskets and valves for food, chemical, petrochemical, pharmaceutical and biotech applications.

KLINGER Group Acquires GPI—January

The KLINGER Group has closed a stock purchase agreement with the West Texas sealing specialist GPI. The company will continue to serve its customers in the industries oil, chemical, power, gas and wastewater. The company operates four locations in Texas. The acquisition of GPI will further strengthen KLINGER’s industrial sealing presence in the U.S.

KSB Divests SPI Energie SAS—January

Pump and valve manufacturer KSB has sold SPI Energie S.A.S., a subsidiary of the KSB Group’s French member KSB S.A.S. The La Ravoire-based company mainly provides services for compressed air systems in industry. With a workforce of 40, KSB SPI Energie generated a sales revenue of 10 million Euros ($11.2) in 2019. The family-run company Duffau specializing in process engineering services is taking over SPI Energie with all its branches and employees.

Ohio Transmission Corp Acquires Laron Inc—January

Laron is a leading service provider of mechanical and electric motor repair, fabrication, engineering, field service, installation, machining and predictive maintenance. The company’s headquarters in Kingman, Arizona, houses large-scale machining, fabrication and repair capabilities. Laron also has repair facilities in Phoenix, Arizona, and Salt Lake City, Utah, and maintains a sales and field service office in Tucson, Arizona. Since its founding, the company has grown to be a service provider supporting the mining, manufacturing, power generation, gas transmission and construction industries.

Tsurumi (Europe) GmbH Acquires Obart Pumps Ltd—February

Tsurumi (Europe) GmbH agreed to acquire 80 percent stake in Obart Pumps (Holdings) Limited. Obart distributes pump products. The company was founded in 1972 and is based in Maidstone, United Kingdom. For over 40 years, Obart has been supplying Tsurumi's construction and wastewater pumps.

Warburg Pincus Acquires Sundyne—January

Sundyne, a manufacturer of flow control equipment, announced that funds advised by Warburg Pincus, a private equity firm focused on growth investing, has agreed to acquire the company from funds advised by BC Partners Advisors L.P. and The Carlyle Group. Terms of the transaction were not disclosed. Sundyne designs, manufactures and provides aftermarket support for highly engineered centrifugal pumps and compressors. The company supplies customers in the oil and gas midstream, LNG, petrochemical, refining, chemicals and industrials sectors.

Wajax Corp Acquires NorthPoint Technical Services ULC—January

Wajax Corporation announced that it has acquired all of the issued and outstanding shares of Calgary, Alberta-based NorthPoint Technical Services ULC (“NorthPoint”). The shares were acquired from an affiliate of Denver, Colorado-based Lion Equity Partners for an aggregate purchase price of CAD 18 million ($13.9). NorthPoint was formed in 2018 as a national electro-mechanical services provider and serves a broad range of resource and industrial customers. Specializing in the repair of rotating industrial equipment, including motors, generators, gearboxes, switchgear, transformers, pumps, fans and turbines, NorthPoint operates nine branches across Canada and employs approximately 177 people. NorthPoint had revenues of approximately CAD 49.2 million ($37.9).

Enterprise value: $13.9 mm; 0.37x Rev

Note: Amounts shown as $ are USD unless noted otherwise. Currency conversions are done at the exchange rate for the relevant period.

Terms: EBITDA—earnings before interest, taxes, depreciation and amortization; EV—enterprise value is the combined amounts of market capitalization, minority interests, preferred stock and net debt; Revenue—amount recorded as net sales for the period.

Abbreviations: b = billions; EV = enterprise value; k = thousand; mm = millions; Rev = Revenue

Sources: company announcements, Capital IQ and SEC filings

Disclaimer: The information provided in this report is not intended to be used for valuation, market comparison, investment or other transaction related purposes.