Thu, 03/02/2017 - 11:03

BARCELONA, Spain (March 2, 2017)—Cutting-edge, smart water solutions are gaining traction with municipal water utilities, which see data and analytics as critical tools for overcoming the age-old issue of crumbling water infrastructure, according to Bluefield Research. More than $20 billion is slated for metering, data management and analytics from 2016 to 2025 globally, Bluefield Research said in a statement.

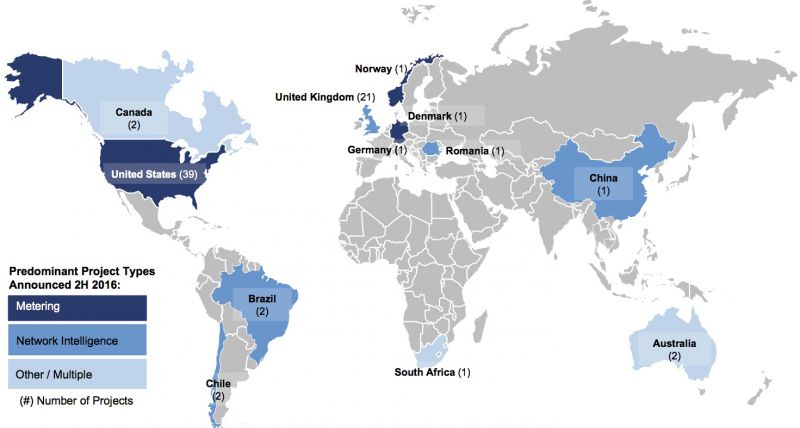

Figure 1. The U.S. (with 39 projects) and U.K. (with 21 projects) were the most active smart water markets during the last six months of 2016, followed regionally by Continental Europe and Latin America. (Courtesy of Bluefield Research)

Figure 1. The U.S. (with 39 projects) and U.K. (with 21 projects) were the most active smart water markets during the last six months of 2016, followed regionally by Continental Europe and Latin America. (Courtesy of Bluefield Research)